DELAFIELD, Wis. (Stockpickr) -- Trading stocks that trigger major breakouts can lead to massive profits. Once a stock trends to a new high or takes out a prior overhead resistance point, then it's free to find new buyers and momentum players who can ultimately push the stock significantly higher.

One example of a successful breakout trade I flagged recently was wireless telecom player China Techfaith Wireless (CNTF), which I featured in Dec. 19's "5 Stocks Under $10 Set to Soar" at $1.50 share. I mentioned in that piece that shares of CNTF had been trending sideways over the last few months, with shares moving between $1.28 on the downside and $1.60 on the upside. Shares of CNTF were just starting to spike higher back above its 50-day moving average of $1.46 a share with strong upside volume. That move was quickly pushing shares of CNTF within range of triggering a big breakout trade above some near-term overhead resistance levels at $1.54 to $1.60 a share.

Guess what happened? Shares of CNTF didn't wait long to trigger that breakout, since the stock started to take out those key overhead resistance levels the following week. Shares of CNTF have continued to uptrend strong since clearing those breakout levels, and shares of CNTF have exploded higher today tagging an intraday high of $2.24 a share. That represents a monster gain of 50% in about a month for anyone who bought this stock once it broke out. As you can see, trading breakouts can lead to massive gains in very short timeframes.

Breakout candidates are something that I tweet about on a daily basis. I frequently tweet out high-probability setups, breakout plays and stocks that are acting technically bullish. These are the stocks that often go on to make monster moves to the upside. What's great about breakout trading is that you focus on trend, price and volume. You don't have to concern yourself with anything else. The charts do all the talking.

Trading breakouts is not a new game on Wall Street. This strategy has been mastered by legendary traders such as William O'Neal, Stan Weinstein and Nicolas Darvas. These pros know that once a stock starts to break out above past resistance levels and hold above those breakout prices, then it can easily trend significantly higher.

With that in mind, here's a look at five stocks that are setting up to break out and trade higher from current levels.

CombiMatrix

One stock that's starting to trend within range of triggering a near-term breakout trade is CombiMatrix (CBMX), which operates a diagnostics reference laboratory that provides DNA-based clinical diagnostic testing services to physicians, hospitals, clinics and other laboratories in the areas of prenatal and postnatal development disorders, and hematology/oncology genomics. This stock hasn't done much over the last three months, with shares up by just 1.4%.

If you take a look at the chart for CombiMatrix, you'll notice that this stock has been uptrending over the last few weeks, with shares moving higher from its low of $2.14 to its recent high of $2.90 a share. During that move, shares of CBMX have been making mostly higher lows and higher highs, which is bullish technical price action. That uptrend has now pushed shares of CBMX within range of triggering a near-term breakout trade.

Traders should now look for long-biased trades in CBMX if it manages to break out above some near-term overhead resistance levels at $2.90 to $2.92 a share, and then once it clears its 200-day moving average at $2.96 to more near-term overhead resistance at $3.20 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average volume of 823,656 shares. If that breakout triggers soon, then CBMX will set up to re-test or possibly take out its next major overhead resistance levels at $3.70 to $4.44 a share.

Traders can look to buy CBMX off any weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average at $2.57 a share or just below more support at $2.20 to $2.14 a share. One can also buy CBMX off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

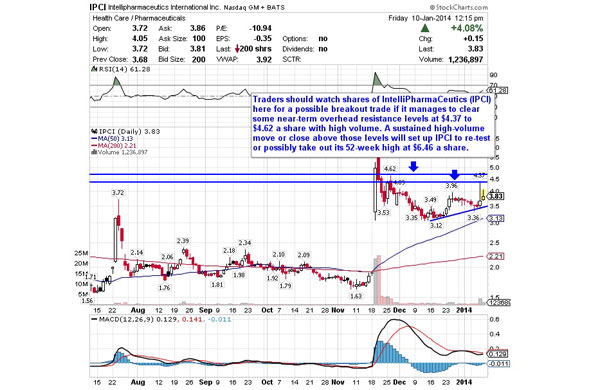

IntelliPharmaCeutics

A pharmaceutical player that's starting to trend within range of triggering a big breakout trade is IntelliPharmaCeutics (IPCI), which specializing in the research, development and manufacture of generic controlled-release and targeted-release oral solid dosage drugs. This stock has been on fire over the last three months, with shares up a whopping 99%.

If you take a look at the chart for IntelliPharmaCeutics, you'll notice that this stock has been uptrending a bit over the last few weeks, with shares moving higher from its low f $3.12 to its recent high of $4.37 a share. During that uptrend, shares of IPCI have been making mostly higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of IPCI within range of triggering a big breakout trade above some key overhead resistance levels.

Traders should now look for long-biased trades in IPCI if it manages to break out some near-term overhead resistance levels at $4.37 to $4.62 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 1.31 million shares. If that breakout triggers soon, then IPCI will set up to re-test or possibly take out its 52-week high at $6.46 a share.

Traders can look to buy IPCI off any weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $3.36 or at its 50-day moving average of $3.13 a share. One could also buy IPCI off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

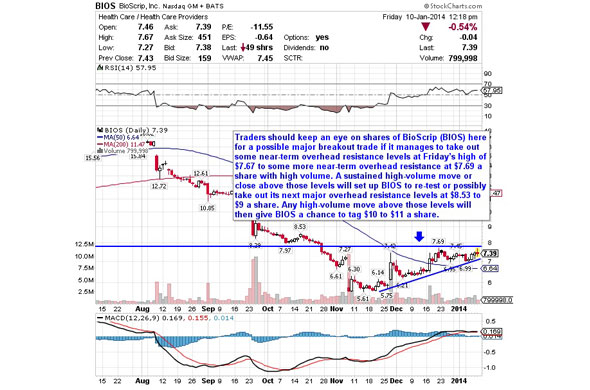

BioScrip

Another stock that's starting to trend within range of triggering a big breakout trade is BioScrip (BIOS), which provides home infusion and other home care services as well as pharmacy benefit management PBM services in the U.S. This stock has been hammered by the bears over the last six months, with shares off sharply by 53%.

If you take a look at the chart for BioScrip, you'll notice that this stock has been uptrending over the last two months, with shares moving higher from its low of $5.61 to its recent high of $7.69 a share. During that uptrend, shares of BIOS have been making mostly higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of BIOS within range of triggering a big breakout trade above some near-term overhead resistance levels.

Traders should now look for long-biased trades in BIOS if it manages to break out above some near-term overhead resistance levels at Friday's high of $7.67 to some more near-term overhead resistance at $7.69 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 1.47 million shares. If that breakout triggers soon, then BIOS will set up to re-test or possibly take out its next major overhead resistance levels at $8.53 to $9 a share. Any high-volume move above those levels will then give BIOS a chance to tag $10 to $11 a share.

Traders can look to buy BIOS off any weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average of $6.64 a share. One can also buy BIOS off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

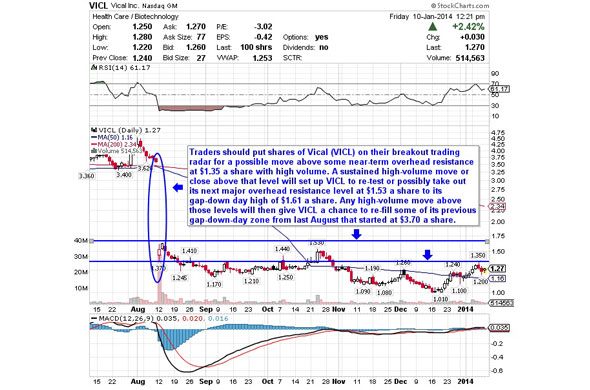

Vical

Another stock that's starting to trend within range of triggering a major breakout trade is Vical (VICL), which engages in the research and development of biopharmaceutical products based on its DNA delivery technologies for the prevention and treatment of serious or life-threatening diseases. This stock has been hit hard by the sellers over the last six months, with shares off sharply by 65%.

If you look at the chart for Vical, you'll notice that this stock has been trending sideways and consolidating over the last two months, with shares moving between $1.01 on the downside and $1.35 on the upside. Shares of VICL have started to uptrend over the last few weeks, with shares moving higher from its low of $1.01 to its recent high of $1.35 a share. During that move, shares of VICL have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now taken shares of VICL back above its 50-day moving average of $1.16 share and it's quickly pushing the stock within range of triggering a major breakout trade.

Traders should now look for long-biased trades in VICL if it manages to break out above some near-term overhead resistance at $1.35 a share with high volume. Look for a sustained move or close above that level with volume that hits near or above its three-month average action of 1.17 million shares. If that breakout hits soon, then VICL will set up to re-test or possibly take out its next major overhead resistance level at $1.53 a share to its gap-down day high of $1.61 a share. Any high-volume move above those levels will then give VICL a chance to re-fill some of its previous gap-down-day zone from last August that started at $3.70 a share.

Traders can look to buy VICL off any weakness to anticipate that breakout and simply use a stop that sits just below its 50-day moving average at $1.20 a share or near more support at $1.10 a share. One can also buy VICL off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Alimera Sciences

My final breakout trading prospect is biopharmaceutical player Alimera Sciences (ALIM), which engages in the research, development, and commercialization of prescription ophthalmic pharmaceuticals. This stock has been red hot over the last three months, with shares up sharply by 46%.

Top 10 Small Cap Companies To Invest In 2014

If you look at the chart for Alimera Sciences, you'll notice that this stock recently gapped up sharply from just over $2.50 to just under $5 a share with heavy upside volume. Following that gap up, shares of ALIM have entered a consolidation pattern with the stock trending sideways between $3.75 on the downside and $5.14 on the upside. Shares of ALIM are now starting to uptrend off those recent lows and it's quickly moving within range of triggering a big breakout trade above the upper-end of its recent sideways trading chart pattern.

Traders should now look for long-biased trades in ALIM if it manages to break out above some near-term overhead resistance levels at $4.83 to $5.14 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 232,033 shares. If that breakout triggers soon, then ALIM will set up to re-test or possibly take out its 52-week high at $5.69 a share. Any high-volume move above that level will then give ALIM a chance to tag its next major overhead resistance level at $8.77 a share.

Traders can look to buy ALIM off any weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $4.29 or at $3.75 a share. One can also buy ALIM off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a conformable percentage from your entry point.

To see more breakout candidates, check out the Breakout Stocks of the Week portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>3 Big-Volume Chinese Stocks to Watch

>>Invest Like a Venture Capitalist With These 5 Stocks

>>5 Rocket Stocks to Buy for Repeat Gains in 2014

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

No comments:

Post a Comment