| Fortinet (NASDAQ: FTNT ) Top 10 Machinery Stocks To Watch Right Now: Danaher Corp (DHR) Danaher Corporation (Danaher) designs, manufactures and markets professional, medical, industrial and commercial products and services. The Company�� research and development, manufacturing, sales, distribution, service and administrative facilities are located in more than 50 countries. It operates in five segments: Test & Measurement; Environmental; Life Sciences & Diagnostics; Dental; and Industrial Technologies. In April 2011, the Company sold its Pacific Scientific Aerospace (PSA) business. On June 30, 2011, the Company acquired Beckman Coulter, Inc. (Beckman Coulter). In January 2012, the Company sold its Accu-Sort businesses. In February 2012, the Company sold its Kollmorgen Electro-Optical (KEO) business. During the year ended December 31, 2011, the Company acquired EskoArtwork, On February 6, 2012, L-3 Communications Holdings, Inc. acquired Kollmorgen Electro-Optical unit of the Company. In January 2013, the Company acquired Navman Wireless. TEST & MEASUREMENT The Company�� Test & Measurement segment is a provider of electronic measurement instruments and monitoring, management and optimization tools for communications and enterprise networks and related services. The segment�� products are used in the design, development, manufacture, installation, deployment and operation of electronics equipment and communications networks and services. Customers for these products and services include manufacturers of electronic instruments; service, installation and maintenance professionals; manufacturers who design, develop, manufacture and install network equipment, and service providers who implement, maintain and manage communications networks and services. The Company�� business designs, manufactures, and markets a variety of compact professional test tools, thermal imaging and calibration equipment for electrical, industrial, electronic and calibration applications. These test products measure voltage, current, resistance, power quality, frequency, p! ressure, temperature and air quality. Typical users of these products include electrical engineers, electricians, electronic technicians, medical technicians, and industrial maintenance professionals. Its business also offers general purpose test products and video test, measurement and monitoring products used in electronic design, manufacturing and advanced technology development. The business��general purpose test products, including oscilloscopes, logic analyzers, signal sources and spectrum analyzers, are used to capture, display and analyze streams of electrical data. The Company sells these products into a variety of industries with electronic content, including the communications, computer, consumer electronics, education, military/aerospace and semiconductor industries. Typical users include research and development engineers who use its general purpose test products to design, de-bug, monitor and validate the function and performance of electronic components, subassemblies and end-products. Its video test products include waveform monitors, video signal generators, compressed digital video test products and other test and measurement equipment used to enhance a viewer�� video experience. Typical users of these products include video equipment manufacturers, content developers and traditional television broadcasters. Products in this business are marketed under the FLUKE, TEKTRONIX, KEITHLEY, RAYTEK, FLUKE BIOMEDICAL, AMPROBE and MAXTEK brands. The communications businesses offer network management solutions, handheld and fixed diagnostic equipment and security solutions, as well as related installation and maintenance services, for a range of private network applications, as well fixed and mobile communications systems. Typical users of the business��products include network engineers, installers, operators, and technicians. Its network management tools help network operators continuously manage network performance and optimize the utilization, uptime and servi! ce qualit! y of the network. Products in this business are marketed under the TEKTRONIX, FLUKE NETWORKS, ARBOR, VISUAL NETWORKS and AIRMAGNET brands. Matco Tools manufactures and distributes professional tools, toolboxes and automotive equipment through independent mobile distributors, who sell primarily to professional mechanics under the MATCO brand. Hennessy Industries is a North American full-line wheel service equipment manufacturer, providing brake lathes, vehicle lifts, tire changers, wheel balancers, and wheel weights under the AMMCO, BADA and COATS brands. Typical users of these products are automotive tire and repair shops. Sales are generally made through its direct sales personnel, independent distributors, retailers, and original equipment manufacturers. ENVIRONMENTAL The Company�� Environmental segment provides products that help protect its water supply and air quality and serves two primary markets: water quality and retail/commercial petroleum. Danaher�� water quality business is engaged in water quality analysis and treatment, providing instrumentation and disinfection systems to help analyze and manage the quality of ultra pure, potable and waste water in residential, commercial, industrial and natural resource applications. Its water quality operations design, manufacture and market a range of analytical instruments, related consumables, and associated services that detect and measure chemical, physical, and microbiological parameters in ultra pure, potable and waste water as well as groundwater and ocean bodies; ultraviolet disinfection systems, which disinfect billions of gallons of municipal, industrial and consumer water every day in more than 35 countries, and industrial water treatment solutions, including chemical treatment solutions intended to address corrosion, scaling and biological growth problems in boiler, cooling water and industrial waste water applications, as well as associated analytical services. Typical users of its analytical in! struments! , ultraviolet disinfection systems, industrial water treatment solutions and related consumables and services include professionals in municipal drinking water and waste water treatment plants and industrial process water and waste water treatment facilities, third-party testing laboratories and environmental field operations. Its water quality business provides products under a variety of well-known brands, including HACH, HACH/LANGE, TROJAN TECHNOLOGIES and CHEMTREAT. Manufacturing facilities are located in North America, Europe, and Asia. The Company has served the retail/commercial petroleum market through its Veeder-Root business. Gilbarco Veeder-Root is a provider of products and services for the retail/commercial petroleum market, including environmental monitoring and leak detection systems; vapor recovery equipment; fuel dispensers; point-of-sale and secure electronic payment technologies for retail petroleum stations; submersible turbine pumps, and remote monitoring and outsourced fuel management services, including compliance services, fuel system maintenance, and inventory planning and supply chain support. Typical users of these products include independent and Company-owned retail petroleum stations, high-volume retailers, convenience stores, and commercial vehicle fleets. The Company markets its retail/commercial petroleum products under a variety of brands, including GILBARCO, VEEDER-ROOT, and GILBARCO AUTOTANK. Manufacturing facilities are located in North America, Europe, Asia and Latin America. Sales are generally made through independent distributors and its direct sales personnel. LIFE SCIENCES & DIAGNOSTICS The Company�� diagnostics businesses offer a range of analytical instruments, reagents, consumables, software and services that hospitals, physician�� offices, reference laboratories and other critical care settings use to diagnose disease and make treatment decisions. Its life sciences businesses offer a range of research and clinical ! tools tha! t are used by scientists to study cells and cell components to gain a better understanding of complex biological matters. Pharmaceutical and biotechnology companies, universities, medical schools and research institutions use these tools to study the causes of disease, identify new therapies and test new drugs and vaccines. The diagnostics business consists of its core lab, acute care and pathology diagnostics businesses. The Company�� core lab diagnostics business is a manufacturer and marketer of biomedical testing instrument systems, tests and supplies that are used to evaluate and analyze samples made up of body fluids, cells and other substances. The information generated is used to diagnose disease, monitor and guide treatment and therapy, assist in managing chronic disease and assess patient status in the hospital, outpatient and physician office settings. Its chemistry systems use electrochemical detection and chemical reactions with patient samples to detect and quantify substances of diagnostic interest in blood and other body fluids. Commonly performed tests include glucose, cholesterol, triglycerides, electrolytes, proteins and enzymes. The Company�� immunoassay systems also detect and quantify chemical substances of diagnostic interest in body fluids, particularly in circumstances where more specialized diagnosis is required. Commonly performed immunoassay tests assess thyroid function, screen and monitor for cancer and cardiac risk and provide important information in fertility and reproductive testing. Its cellular analysis business includes hematology, flow cytometry and coagulation products. The business��hematology systems use principles of physics, optics, electronics and chemistry to separate cells of diagnostic interest and then quantify and characterize them, allowing clinicians to study formed elements in blood (such as red and white blood cells and platelets). The business also distributes coagulation products, which rely on clotting, chromogenic! and immu! nologic technologies to provide the detailed information that clinicians require to diagnose bleeding and clotting disorders and to monitor anticoagulant therapy. It also offer systems and workflow solutions that allow laboratories to automate a number of steps from the pre-analytical through post-analytical stages including sample barcoding/information tracking, centrifugation, aliquotting, storage and conveyance. These systems along with the analyzers above are controlled through laboratory level software that enables laboratory managers to monitor samples, results and lab efficiency. The Company�� acute care diagnostics business is a provider of instruments and related consumables and services that are used in both laboratory and point-of-care environments to rapidly measure critical parameters, including blood gases, electrolytes, metabolites and cardiac markers. Typical users of these products include hospital central laboratories, intensive care units, hospital operating rooms and hospital emergency rooms. Its pathology diagnostics business is engaged in the anatomical pathology market, offering a suite of instrumentation and related consumables used across the entire workflow of a pathology laboratory. Its pathology diagnostics products include tissue embedding, processing and slicing (microtomes) instruments and related reagents and consumables; chemical and immuno-staining instruments, reagents, antibodies and consumables; slide coverslipping and slide/cassette marking instruments, and imaging instrumentation including slide scanners, microscopes, cameras and associated software. Typical users of these products include pathologists, lab managers and researchers. Its diagnostics business generally markets its products under the BECKMAN COULTER, LEICA BIOSYSTEMS, RADIOMETER and SURGIPATH brands. Manufacturing facilities are located in North America, Europe, Asia and Australia. The businesses sell to customers primarily through direct sales personnel and to a lesser extent through ! independe! nt distributors. The Company�� microscopy business is a provider of professional microscopes designed to manipulate, preserve and capture images of, and enhance the user�� visualization of, microscopic structures. Its microscopy products include laser scanning (confocal) microscopes; compound microscopes and related equipment; surgical and other stereo microscopes; specimen preparation products for electron microscopy; and digital image capture and manipulation equipment. The Company also offers workflow instruments and consumables that help researchers analyze genomic, protein and cellular information. Key product areas include sample preparation equipment, such as centrifugation and capillary electrophoresis instrumentation and consumables; liquid handling automation instruments and associated consumables; flow cytometry instrumentation and associated antibodies and reagents; and particle characterization instrumentation. The business also offers genome profiling services. Researchers use the business��products to study biological function in the pursuit of basic research, therapeutic and diagnostic development. Typical users of these products include pharmaceutical and biotechnology companies, universities, medical schools and research institutions and in some cases industrial manufacturers. The Company�� mass spectrometry business is a provider of high-end mass spectrometers. Mass spectrometry is a technique for identifying, analyzing and quantifying elements, chemical compounds and biological molecules, individually or in complex mixtures. Its products utilize various combinations of quadrupole, time-of-flight and ion trap technologies, and are typically used in conjunction with a third party liquid chromatography instrument. Its mass spectrometer systems are used in numerous applications, such as drug discovery and clinical development of therapeutics as well as in basic research, clinical testing, food and beverage quality testing and environmental testing. To s! upport it! s installations around the world, it provides implementation, validation, training, maintenance and support from its global services network. Typical users of its mass spectrometry products include molecular biologists, bioanalytical chemists, toxicologists, and forensic scientists, as well as quality assurance and quality control technicians. It also provides high-performance bioanalytical measurement systems, including microplate readers, automated cellular screening products and associated reagents, and imaging software. Typical users of these products include biologists and chemists engaged in research and drug discovery, who use these products to determine electrical or chemical activity in cell samples. Its life sciences business generally markets its products under the LEICA MICROSYSTEMS, BECKMAN COULTER, AB SCIEX and MOLECULAR DEVICES brands. Manufacturing facilities are located in Europe, Australia, Asia and North America. DENTAL The Company�� Dental segment is a provider of a range of consumables, equipment and services for the dental market, which encompasses the diagnosis, treatment and prevention of disease and ailments of the teeth, gums and supporting bone. Its dental businesses develop, manufacture and market dental consumables and dental equipment orthodontic bracket systems and lab products; impression, bonding and restorative materials; endodontic systems and related consumables; infection prevention products, and diamond and carbide rotary instruments. Typical customers and users of these products include general dentists, dental specialists, dental hygienists, dental laboratories and other oral health professionals, as well as educational, medical and governmental entities. Its dental products are marketed primarily under the KAVO, GENDEX, iCAT, INSTRUMENTARIUM DENTAL, SOREDEX, PELTON & CRANE, DEXIS, ORMCO, KERR, PENTRON, SYBRON ENDO and TOTAL CARE brands. INDUSTRIAL TECHNOLOGIES The Company�� Industrial Technologies segment ! designs a! nd manufactures components and systems that are typically incorporated by original equipment manufacturers (OEMs) and systems integrators for sale into a diverse set of applications and end-markets. The businesses in this segment also provide service and support, including helping customers with integration and installation and providing services to ensure performance and up-time. Danaher�� product identification business is a global provider of equipment and consumables for variable printing, marking and coding on a variety of consumer and industrial products. Its businesses design, manufacture, and market a variety of equipment used to print bar codes, date codes, lot codes, and other information on primary and secondary packaging. Its equipment can apply alphanumeric codes, logos and graphics to a range of surfaces at a variety of line speeds, angles and locations on a product or package. EskoArtwork, the business is a service solutions provider for the digital packaging design and production market. Typical users of the product identification business��products include food and beverage manufacturers, pharmaceutical manufacturers, retailers and commercial printing and mailing operations. Its product identification products are primarily marketed under the VIDEOJET, LINX, FOBA and ESKOARTWORK brands. Manufacturing facilities are located in North America, Europe, Latin America, and Asia. The Company is a provider of electromechanical motion control solutions for the industrial automation and packaging markets. Its businesses provide a range of products including standard and custom motors; drives; controls, and mechanical components, such as ball screws, linear bearings, clutches/brakes, and linear actuators. The products are sold in various precision motion markets, such as the markets for packaging equipment, medical equipment, robotics, circuit board assembly equipment, elevators and electric vehicles (such as lift trucks). Its motion products are marketed under a vari! ety of br! ands, including KOLLMORGEN, THOMSON, DOVER and PORTESCAP. Manufacturing facilities are located in North America, Europe, Latin America, and Asia. Its sensors and controls products include instruments that monitor, sense and control discrete manufacturing variables such as temperature, position, quantity, level, flow and time. Users of these products span a wide variety of manufacturing markets. Certain businesses included in this group also make and sell instruments, controls and monitoring systems used by the electric utility industry to monitor their transmission and distribution systems, as well as automatic identification solutions. The products are marketed under a variety of brands, including DYNAPAR, HENGSTLER, IRIS POWER, WEST, GEMS SENSORS, SETRA and QUALITROL. Sales are generally made through our direct sales personnel and independent distributors. The Company�� defense business designs, manufactures, and markets energetic material systems. Typical users of these products include defense systems integrators and prime contractors. defense products are typically marketed under the PACIFIC SCIENTIFIC ENERGETIC MATERIALS COMPANY brand. The KEO business designs, develops, manufactures and integrates highly engineered, stabilized electro-optical/ISR systems that integrate into submarines, surface ships and ground vehicles. Jacobs Vehicle Systems (JVS) is a supplier of supplemental braking systems for commercial vehicles, selling JAKE BRAKE brand engine retarders for class 6 through 8 vehicles and bleeder and exhaust brakes for class 2 through 7 vehicles. Customers are primarily manufacturers of class 2 through class 8 vehicles, and sales are typically made through its direct sales personnel. Manufacturing facilities of its sensors and controls, defense and JVS businesses are located in North America, Latin America, Europe and Asia. Advisors' Opinion: - [By Kathy Kristof]

Headquarters: Washington, D.C.

52-Week High: $56.06

52-Week Low: $40.36

Annual Sales: $16.1 bill.

Projected Earnings Growth: 15% annually over the next five years

Danaher was an industrial conglomerate made up of disparate cyclical businesses. Then, in 1990, management opted to restructure to focus on five key areas in which it believed it could become a global leader.

The wisdom of the strategy proved itself in 2009 as the nation struggled with the recession precipitated by the financial crisis, says Morningstar analyst Daniel Holland. Although revenues of many of its rivals were cut in half that year, Danaher saw its sales drop about 12% and bounce back nicely in 2010. Revenues and profits have continued to rise by double-digit percentages. Second-quarter profits and sales jumped 31% and 28% respectively from the year-earlier period.

Danaher’s growth is primarily fueled by acquisitions, which it does unusually well. Danaher’s latest purchase, of Beckman Coulter last year, has not only proved profitable, it has put 40% of the company’s sales in the rapidly growing health care sector.

Top 10 Machinery Stocks To Watch Right Now: Rockwell Automation Inc.(ROK) Rockwell Automation, Inc. provides industrial automation power, control, and information solutions. It operates in two segments, Architecture and Software, and Control Products and Solutions. The Architecture and Software segment offers control platforms that perform multiple control disciplines and monitoring of applications, including discrete, batch and continuous process, drives control, motion control, and machine safety control; and products comprising controllers, electronic operator interface devices, electronic input/output devices, communication and networking products, and industrial computers. This segment also offers software products, such as configuration and visualization software used to operate and supervise control platforms, advanced process control software, and manufacturing execution software to enhance manufacturing productivity and meet regulatory requirements; and rotary and linear motion control products, and sensors and machine safety components . The Control Products and Solutions segment provides low and medium voltage electro-mechanical and electronic motor starters, motor and circuit protection devices, AC/DC variable frequency drives, push buttons, signaling devices, termination and protection devices, relays and timers, and condition sensors; and packaged solutions, such as configured drives and motor control centers to automation and information solutions, as well as life-cycle support services. The company sells its products, solutions, and services primarily under the Rockwell Automation, Allen-Bradley, A-B, and Rockwell Software brand names to the food and beverage, transportation, oil and gas, metals, mining, home and personal care, pulp and paper, and life sciences markets through independent distributors and direct sales force in the United States, Canada, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. Rockwell Automation, Inc. was founded in 1928 and is headquartered in Milwaukee , Wisconsin. Cummins Inc. designs, manufactures, distributes, and services diesel and natural gas engines, electric power generation systems, and engine-related component products worldwide. It operates in four segments: Engine, Power Generation, Components, and Distribution. The Engine segment offers a range of diesel and natural gas powered engines under the Cummins and other customer brand names for the heavy-and medium-duty truck, bus, recreational vehicle, light-duty automotive, agricultural, construction, mining, marine, oil and gas, rail, and governmental equipment markets. This segment also provides new parts and service, as well as remanufactured parts and engines. The Power Generation segment offers power generation systems, components, and services, including diesel, natural gas, gasoline, and alternative-fuel electrical generator sets for use in recreational vehicles, commercial vehicles, recreational marine applications, and home stand-by or residential applications. This segment also provides components that make up power generation systems, such as engines, controls, alternators, transfer switches, and switchgears. The Components segment supplies filtration products, turbochargers, aftertreatment systems, intake and exhaust systems, and fuel systems for commercial diesel applications. This segment offers filtration and exhaust systems for on-and off-highway heavy-duty and mid-range equipment, as well as supplies filtration products for industrial and passenger car applications. This segment also develops after treatment and exhaust systems to help customers meet emissions standards and fuel systems. The Distribution segment provides parts and services, as well as service solutions, including maintenance contracts, engineering services, and integrated products. The company sells its products to original equipment manufacturers, distributors, and other customers. Cummins Inc. was founded in 1919 and is headquartered in Columbus, Indiana. Advisors' Opinion: - [By Matthew Scott]

While trucking manufacturing Cummins (NYSE: CMI) is hardly a sexy stock, fleets of environmentally friendly trucks will be essential for many world economies to remain competitive as they slowly make their way out of the last recession. The price of Cummins’ stock has increased more than five and a half times in two years, jumping from $19.09 on March 9, 2009 to $109.62 at the end of the first quarter this year. As world economies begin to improve, transportation companies will begin replacing trucks so that they can move higher volumes of products more efficiently, and Cummins will benefit.

Top 10 Machinery Stocks To Watch Right Now: Terex Corporation(TEX) Terex Corporation manufactures capital goods machinery products worldwide. Its Aerial Work Platforms segment offers portable material lifts, portable aerial work platforms, trailer-mounted articulating booms and light towers, self-propelled articulating and telescopic booms, scissor lifts, telehandlers, and bridge inspection and utility equipment under the Terex and Genie brands. The company?s Construction segment provides off-highway trucks and material handlers; loader backhoes, compaction equipment, mini and midi excavators, site dumpers, compact track loaders, skid steer loaders, wheel loaders, and tunneling equipment; and asphalt and concrete equipment, and landfill compactors principally under the Terex name. Its Cranes segment offers mobile telescopic and tower cranes, lattice boom crawler and truck cranes, and truck-mounted cranes; and straddle and sprinter carriers, gantry cranes, ship-to-shore cranes, reach stackers, empty and full container handlers, and genera l cargo lift trucks under the Terex brand. The company?s Material Handling and Port Solutions segment provides standard and process cranes, rope and chain hoists, electric motors, and light crane systems; and crane components and port equipment, such as mobile harbor and automated stacking cranes, and automated guided vehicles, as well as terminal automation technology, including software under the Demag and Gottwald names. Its Materials Processing segment offers crushers, washing systems, screens, apron feeders, chippers, and related components and replacement parts under the Terex and Powerscreen brands. The company provides financing solutions to assist customers in the rental, leasing, and acquisition of its products. It serves construction, infrastructure, quarrying, mining, manufacturing, shipping, transportation, refining, energy, and utility industries through dealers, rental companies, direct sales, and major accounts. The company was founded in 1925 and is based i n Westport, Connecticut. Top 10 Machinery Stocks To Watch Right Now: Caterpillar Inc.(CAT) Caterpillar Inc. manufactures and sells construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives worldwide. It operates through three lines of businesses: Machinery, Engines, and Financial Products. The Machinery business offers construction, mining, and forestry machinery, including track and wheel tractors, track and wheel loaders, pipelayers, motor graders, wheel tractor-scrapers, track and wheel excavators, backhoe loaders, log skidders, log loaders, off-highway trucks, articulated trucks, paving products, skid steer loaders, underground mining equipment, tunnel boring equipment, and related parts. It also manufactures diesel-electric locomotives; and manufactures and services rail-related products and logistics services for other companies. The Engines business provides diesel, heavy fuel, and natural gas reciprocating engines for Caterpillar machinery, electric power generation systems, marine, petrol eum, construction, industrial, agricultural, and other applications. It offers industrial turbines and turbine-related services for oil and gas, and power generation applications. This business also remanufactures Caterpillar engines, machines, and engine components; and offers remanufacturing services for other companies. The Financial Products business provides retail and wholesale financing alternatives for Caterpillar machinery and engines, solar gas turbines, and other equipment and marine vessels, as well as offers loans and various forms of insurance to customers and dealers. It also offers financing for vehicles, power generation facilities, and marine vessels. The company markets its products directly, as well as through its distribution centers, dealers, and distributors. It was formerly known as Caterpillar Tractor Co. and changed its name to Caterpillar Inc. in 1986. Caterpillar Inc. was founded in 1925 and is headquartered in Peoria, Illinois. Advisors' Opinion: - [By Dave Friedman]

The shares closed at $91.37, up $1.56, or 1.74%, on the day. They have traded in a 52-week range of $63.34 to $116.55. Volume today was 10,450,473 shares, against a 3-month average volume of 9,960,260 shares. Its market capitalization is $59.03billion, its trailing P/E is 15.11, its trailing earnings are $6.05 per share, and it pays a dividend of $1.84 per share, for a dividend yield of 2.00%. About the company: Caterpillar Inc. designs, manufactures, and markets construction, mining, agricultural, and forestry machinery. The Company also manufactures engines and other related parts for its equipment, and offers financing and insurance. Caterpillar distributes its products through a worldwide organization of dealers. - [By Sam Collins]

Caterpillar (NYSE:CAT) is the world’s largest producer of construction and mining equipment, diesel and natural gas engines, and industrial gas turbines. The stock has been in a bull market since the market bottomed in March 2009. CAT was one of our Top Stocks to Buy for December because of its position as a major supplier to the third world and China. The company should also be a beneficiary of orders from Japan due to the damage from earthquakes and the tsunami. Revenues in 2011 are expected to increase by 36%, according to S&P, and margins are expected to increase, as well. Earnings for 2012 are forecast at $9.10, up from $7.50 this year, and S&P has a target of $142 over the next 12 months. Technically CAT has strong support at $95 and currently appears to be oversold, according to Moving Average Convergence/Divergence (MACD). If it is able to hold at the support line, look for a rally to $110 within 30 days. Longer term the stock could trade north of $125. - [By Jim Cramer]

this stock could be a monster in 2011, especially with the integration of Bucyrus (BUCY), which I think will turn out to be a fantastic acquisition. Estimates, currently showing EPS at about $6, I think are way, way too low. I see this stock going to $120 in the next year. Too gutsy? Ask yourself what happens if the United States comes back as a growth nation. Right now almost all of the growth is overseas. Still a fantastic mineral play and a terrific call on world growth. - [By Jim Cramer,TheStreet]

Caterpillar (CAT) could be a monster in 2011, especially with the integration of Bucyrus International (BUCY), which I think will turn out to be a fantastic acquisition. Current earnings-per-share estimates of about $6 are, I think, way too low. I see this stock going to $120 in the next year. Too gutsy? Ask yourself what happens if the United States comes back as a growth nation? Right now almost all of the growth is overseas. Still a fantastic mineral play and a terrific call on world growth.

Top 10 Machinery Stocks To Watch Right Now: Barnes Group Inc (B) Barnes Group Inc. is an international aerospace and industrial components manufacturer and logistics services company serving a range of end markets and customers. The products and services provided by Barnes Group are critical components for applications, which provide transportation, communication, manufacturing and technology. The Company operates under two global business segments: Logistics and Manufacturing Services, and Precision Components. On December 30, 2011, the Company sold its Barnes Distribution Europe (BDE) business to Berner SE. In August 2012, the Company acquired Synventive Molding Solutions. Logistics and Manufacturing Services Logistics and Manufacturing Services provides logistics support and repair services. Value-added logistics support services include inventory management, technical sales, and supply chain solutions for maintenance, repair, operating, and production supplies and services. Repair services provided include the manufacturing of spare parts for the refurbishment and repair of engineered components and assemblies for commercial and military aviation. Logistics and Manufacturing Services has sales, distribution, and manufacturing operations in the United States, Brazil, Canada, China, France, Mexico, Singapore, Spain and the United Kingdom. Products and services are available in more than 30 countries. The global operations are engaged in supplying, servicing and manufacturing of maintenance, repair and operating components. Activities include logistics support through vendor-managed inventory and technical sales for stocked replacement parts and other products, catalog offerings and custom solutions, and the manufacture and delivery of aerospace aftermarket spare parts, including the revenue sharing programs (RSPs) under, which the Company receives right to supply designated aftermarket parts over the life of the related aircraft engine program, and component repairs. In addition, the manufacturing and supplying of aerospace! aftermarket spare parts, including the RSPs, are dependent upon the reliable and timely delivery of components. Precision Components Precision Components is a global supplier of engineered components for critical applications focused on providing solutions for a industrial, transportation and aerospace customer base. It is equipped to produce every type of precision spring, from fine hairsprings for electronics and instruments to heavy-duty springs for machinery, as well as precision-machined and fabricated components and assemblies for OEM turbine engine, airframe and industrial gas turbine builders globally, and the military. It is also a manufacturer and supplier of precision mechanical products, including precision mechanical springs, compressor reed valves and nitrogen gas products. Precision Components also manufactures punched and fine-blanked components used in transportation and industrial applications, nitrogen gas springs and manifold systems used to control stamping presses, and retention rings, which position parts on a shaft or other axis. Precision Components has a customer base with products purchased by durable goods manufacturers located in industries, including transportation, consumer products, farm equipment, telecommunications, medical devices, home appliances and electronics, and airframe and gas turbine engine manufacturers for commercial and military jets, business jets, and land-based industrial gas turbines. Long-standing customer relationships enable Precision Components to participate in the design phase of components and assemblies, through which customers receive the benefits of manufacturing research, testing and evaluation. Products are sold through Precision Components��direct sales force and a distribution channel. Precision Components has manufacturing, sales, assembly and distribution operations in the United States, Brazil, Canada, China, Germany, Korea, Mexico, Singapore, Sweden, Switzerland, Thailand and the United Kingdo! m. Top 10 Machinery Stocks To Watch Right Now: AGCO Corporation (AGCO) AGCO Corporation manufactures and distributes agricultural equipment and related replacement parts worldwide. The company provides tractors, including compact tractors for small farms and specialty agricultural industries comprising dairies, landscaping, and residential areas; utility tractors, such as two-wheel and all-wheel drive versions for small and medium-sized farms, and specialty agricultural industries consist of dairy, livestock, orchards, and vineyards; and horsepower tractors for large farms and on cattle ranches for hay production. It also offers application equipment, which includes self-propelled, three and four-wheeled vehicles, and related equipment for use in the application of liquid and dry fertilizers, and crop protection chemicals; chemical sprayer equipment for planting crops; and related equipment that comprises vehicles for waste application, as well as provides combines. In addition, the company offers hay tools and forage equipment consisting rou nd and rectangular balers, self-propelled windrowers, disc mowers, spreaders and mower conditioners for harvesting and packaging vegetative feeds; and engines, such as diesel engines, gears, and generating sets. Further, it provides implements, including disc harrows for improving field performance; heavy tillage to break up soil and mix crop residue; and field cultivators for preparing smooth seed bed and destroy weeds, as well as offers tractor-pulled planters and loaders. Additionally, the company provides precision farming technologies to enhance productivity and profitability on the farm; and other advanced technology precision farming products to gather information, such as yield data, as well as offers wholesale financing and retail financing. It markets its products under the Challenger, Fendt, Massey Ferguson, and Valtra brand names through a network of independent dealers and distributors. AGCO Corporation was founded in 1990 and is headquartered in Duluth, Georgia . Top 10 Machinery Stocks To Watch Right Now: First Majestic Silver Corp.(AG) First Majestic Silver Corp. engages in the production, development, exploration, and acquisition of mineral properties with a focus on silver in Mexico. The company owns interests in La Encantada Silver Mine comprising 4,076 hectares of mining rights and 1,343 hectares of surface land located in Coahuila; La Parrilla Silver Mine consisting of mining concessions covering an area of 69,867 hectares; and San Martin Silver Mine comprising approximately 7,841 hectares of mineral rights and approximately 1,300 hectares of surface land rights located in Jalisco. It also holds interests in Del Toro Silver Mine consisting of 393 contiguous hectares of mining claims and an additional 129 hectares of surface rights located in Zacatecas; Real de Catorce Silver Project comprising 22 mining concessions covering 6,327 hectares located in San Luis Potosi state; and Jalisco Group of Properties consisting of mining claims totalling 5,240 hectares located in Jalisco. The company was founded in 1979 and is headquartered in Vancouver, Canada. Advisors' Opinion: - [By Sy_Harding]

First Majestic Silver is one of the purest silver plays on the market. The company owns and operates three primary silver mines in Mexico: La Parrilla, San Martin, and La Encantada. Shares of AG have risen more than 60% for the year. First Majestic generates 85% of its revenue through the production and sale of silver. The rest of the company's revenue is generated through gold, lead, and zinc. First Majestic expects to increase total silver output from its operations to 7.5 million ounces of silver in 2011, and up to 16.0 million ounces by 2014. - [By Goodwin]

The shares closed at $88.19, down $1.1, or 1.23%, on the day. Its market capitalization is $77.08 billion. About the company: Siemens AG manufactures a wide range of industrial and consumer products. The Company builds locomotives, traffic control systems, automotive electronics, and engineers electrical power plants. Siemens also provides public and private communications networks, computers, building control systems, medical equipment, and electrical components. The Company operates worldwide.

Top 10 Machinery Stocks To Watch Right Now: Cleantech Transit Inc (CLNO) Cleantech Transit, Inc., incorporated on June 28, 2006, is a development-stage company. The Company focuses to explore opportunities in the development and production of hybrid, electric, alternative fuel and diesel heavy duty transit buses, luxury motor coaches and tour buses. On July 11, 2011, the Company formed Cleantech Energy, Inc. as a wholly owned subsidiary. In February 2013, the Company announced that acquired from Crown Equity Holdings Inc., Crown Buy Rite. On July 25, 2011, the Company formed Cleantech Exploration Corp. as a wholly owned subsidiary. On October 31, 2011, the Company acquired a 40% interest in Ortigalita Power Systems, LLC a waste power generating project in California.

When the original estimates for capital expenditures for 2013 came out, it looked as though oil services might be the place to be. Based on the recent earnings release from Nabors Industries (NYSE: NBR ) , though, you might think otherwise. Here's the problem: Nabors is stuck between two emerging trends that could put a big squeeze on the rig company. Let's look at these two trends and Nabors' one hope for a better future. Not everybody wins with greater efficiency

In�comparison with the rest of the oil and gas industry, horizontal drilling and hydraulic fracturing are still very young technologies. As exploration and production companies have�become�more�familiar�with the processes, they have also been able to eke out more�efficient�drilling. One major revolution that has brought along big savings is the concept of pad drilling, or drilling multiple wells within a couple of feet of each other to tap different parts of the oil formation below. Thanks to these gains in efficiency, companies have been able to drill more wells while using less drilling rigs. Top Oil Service Stocks To Invest In Right Now: WellPoint Inc.(WLP) WellPoint, Inc., through its subsidiaries, operates as a health benefits company in the United States. The company offers various network-based managed care plans to large and small employer, individual, Medicaid, and senior markets. Its managed care plans include preferred provider organizations; health maintenance organizations; point-of-service plans; traditional indemnity plans; and other hybrid plans, including consumer-driven health plans, hospital only, and limited benefit products. The company also provides various managed care services comprising claims processing, underwriting, stop loss insurance, actuarial services, provider network access, medical cost management, disease management, wellness programs, and other administrative services to self-funded customers. In addition, it offers specialty and other products and services, including life and disability insurance benefits; dental, vision, and behavioral health benefit services; radiology benefit management; personal health care guidance; and long-term care insurance. Further, the company serves as an intermediary providing administrative service for the Medicare program that offers coverage for persons, who are 65 or older and for persons who are disabled or with end-stage renal disease. WellPoint, Inc. markets its products through a network of independent agents and brokers, consultants, in-house sales force, or Internet. The company, formerly known as Anthem, Inc., was founded in 1944 and is headquartered in Indianapolis, Indiana. Top Oil Service Stocks To Invest In Right Now: Ishares Nasdaq Biotechnology (IBB) iShares Nasdaq Biotechnology Index Fund (the Fund) seeks investment results that correspond generally to the price and yield performance of the NASDAQ Biotechnology Index (the Index). The Index consists of securities of NASDAQ-listed companies that are classified according to the Industry Classification Benchmark as either biotechnology or pharmaceuticals, and which also meet other eligibility criteria. The Index is one of the eight sub-indices of the NASDAQ Composite, which measures all common stocks listed on The NASDAQ Stock Market, Inc. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. The Fund�� investment advisor is Barclays Global Fund Advisors. 5 Best Dividend Stocks To Buy For 2014: Chelsea Therapeutics International Ltd.(CHTP) Chelsea Therapeutics International, Ltd., a development-stage pharmaceutical company, focuses on the acquisition, development, and commercialization of therapeutic products for the treatment of various human diseases. It is involved in developing Droxidopa, a therapeutic agent for the treatment of symptomatic neurogenic orthostatic hypotension (NOH) associated with primary autonomic failure and falls related to NOH in Parkinson?s Disease (PD), as well as other norepinephrine-related conditions and diseases, including intradialytic hypotension, fibromyalgia, adult attention deficit hyperactivity disorder, chronic fatigue syndrome, and freezing of gait in PD and down syndrome. The company intends to market its Droxidopa drug under the Northera brand name. It also engages in developing a portfolio of molecules for the treatment of various autoimmune/inflammatory diseases, including rheumatoid arthritis, psoriasis, Crohn?s disease, ankylosing spondylitis, uveitis, psoriatic arthritis, inflammatory bowel disease, cancer, and other immunological disorders. The company?s molecule products include a portfolio of metabolically inert antifolate molecules consisting of CH-1504 and CH-4051, which are orally available molecules with anti-inflammatory, autoimmune, and anti-tumor properties that inhibit various key enzymes required for cell proliferation; and a portfolio of dihydroorotate dehydrogenase, known as the I-3D portfolio, for applications in autoimmune diseases and transplantation. Chelsea Therapeutics International, Ltd. was founded in 2002 and is headquartered in Charlotte, North Carolina.

The following video is from Tuesday's Investor Beat, in which host Chris Hill, and analysts Jason Moser and Matt Koppenheffer dissect the hardest-hitting investing stories of the day. New-home sales hit their highest point in almost five years in May, rising 2.1% from the previous month. In other housing news, the Case-Shiller index of home prices in 10 major markets increased 1.8% in April. In this installment of Investor Beat, Motley Fool analysts Matt Koppenheffer and Jason Moser discuss how investors should analyze the housing market, and why bank stocks are the hidden winners. With the American markets reaching new highs, investors and pundits alike are skeptical about future growth. They shouldn't be. Many global regions are still stuck in neutral, and their resurgence could result in windfall profits for select companies. A recent Motley Fool report, "3 Strong Buys for a Global Economic Recovery" outlines three companies that could take off when the global economy gains steam. Click here to read the full report! The relevant video segment can be found between 0:14 and 2:45.

Consumer confidence is up for the third straight month, notching a 9.6% gain for June, according to The Conference Board's June Consumer Confidence report released today. After hitting a five-year high last month, this latest 81.4 index reading (once again) puts consumer confidence at its highest level since January 2008. Analysts were taken by surprise, having expected a slight dip from May's unrevised numbers to 75. Despite June's jubilee, confidence still remains well below the index's 1985 100-point benchmark. "Consumers are considerably more positive about current business and labor market conditions than they were at the beginning of the year," said Lynn Franco, director of economic indicators at The Conference Board, in a statement today. "Expectations have also improved considerably over the past several months, suggesting that the pace of growth is unlikely to slow in the short-term, and may even moderately pick up." The index is comprised of responses from a random sample of consumers and, in this latest report, optimism showed some gains. Most notably, consumers claiming jobs are "plentiful" pushed up 1.8 percentage points to 11.7%, although those citing jobs as "hard to get" also increased 0.5 points to 36.9%. Looking ahead, 20.3% of those surveyed expected business conditions to improve over the next six months, compared to just 11.4% anticipating tougher times. Optimists managed to outweigh pessimists for labor market conditions, as well. A 3.3-percentage-point increase put those expecting more jobs at 19.6%, while respondents predicting fewer jobs fell 3.9 points to 16.1%. link

Until recently, investors were forced to choose among module suppliers for exposure to the solar industry. But SolarCity (NASDAQ: SCTY ) has brought a new model to the market: Leases provide stable and predictable cash flows to SolarCity investors, and with solar installations growing like weeds, the company is building a great base for the future. Fool.com contributor Travis Hoium sat down to discuss why SolarCity is so hot, and talks about other solar companies to watch. One company SolarCity is outperforming on the market is First Solar, formerly the hottest company in solar. Is it done for good, or ready for a rebound? If you're looking for continuing updates and guidance on the company whenever news breaks, The Motley Fool has created a brand-new report that details every must know side of this stock. To get started, simply click here now. Top 10 Performing Stocks To Buy For 2014: Medical Corporation Australasia Ltd (MOD.AX) MOD Resources Limited engages in the exploration and development of mineral resources. Its projects include Botswana Copper project covering an area of approximately 8,600 square kilometers on the Kalahari Copper Belt in Botswana; and Sams Creek Gold project, an undeveloped gold project in New Zealand. The company was formerly known as Medical Corporation Australasia Limited and changed its name to MOD Resources Limited in July 2011. MOD Resources Limited is based in Subiaco, Australia. Top 10 Performing Stocks To Buy For 2014: Investors Title Company(ITIC) Investors Title Company, through its subsidiaries, provides title insurance to residential, institutional, commercial, and industrial properties. It underwrites land title insurance for owners and mortgagees as a primary insurer; and offers the reinsurance of title insurance risks to other title insurance companies. The company also provides tax-deferred real property exchange services, as well as serves as an exchange accommodation titleholder and holds property for exchangers in reverse exchange transactions; offers investment management and trust services to individuals, companies, banks, and trusts; and provides consulting services to title insurance agencies. Investors Title Company serves various customers in the residential and commercial market sectors of the real estate industry. It issues title insurance policies primarily through approved attorneys from underwriting offices, as well as through independent issuing agents in 24 states and the District of Columbia, the United States. The company was founded in 1972 and is headquartered in Chapel Hill, North Carolina. Top 5 Companies To Watch For 2014: On Assignment Inc.(ASGN) On Assignment, Inc., a diversified professional staffing firm, provides flexible and permanent staffing solutions in the United States, Europe, Canada, Australia, and New Zealand. The company?s Life Sciences segment provides contract and permanent life science professionals to clients in the biotechnology, pharmaceutical, food and beverage, personal care, chemical, medical device, automotive, municipal, education, and environmental industries. Its contract professionals include chemists, clinical research associates, clinical lab assistants, engineers, biologists, biochemists, microbiologists, molecular biologists, biostatisticians, drug safety specialists, SAS programmers, medical writers, food scientists, regulatory affairs specialists, lab assistants, and other skilled scientific professionals. The company?s Healthcare segment offers locally-based and traveling contract professionals that include nurses, specialty nurses, respiratory therapists, surgical technicians, imaging technicians, X-ray technicians, medical technologists, medical assistants, pharmacists, pharmacy technicians, respiratory therapists, phlebotomists, coders, billers, claims processors, and collections staff, as well as dental professionals. This segment serves hospitals, integrated delivery systems, imaging centers, clinics, physician offices, reference laboratories, universities, managed care organizations, and third-party administrators. Its Physician segment provides short and long-term locum tenens services, and full-service physician search and consulting services. The company?s IT and Engineering segment offers high-end contract and direct placement services of information technology and engineering professionals with expertise in specialized information technology; software and hardware engineering; and mechanical, electrical, validation, and telecommunications engineering fields. On Assignment, Inc. was founded in 1985 and is headquartered in Calabasas, Cali fornia. Top 10 Performing Stocks To Buy For 2014: Baldwin & Lyons Inc.(BWINB) Baldwin & Lyons, Inc., through its subsidiaries, engages in marketing and underwriting property and casualty insurance products primarily in the United States. The company provides various fleet transportation insurance products, including casualty insurance, such as motor vehicle liability, physical damage, and other liability insurance; workers compensation insurance; specialized accident (medical and indemnity) insurance products for independent contractors; fidelity and surety bonds; and inland marine products consisting of cargo insurance. It offers its fleet transportation insurance products for motor carrier industry. The company also provides various additional services comprising risk surveys and analyses, government compliance assistance, loss control, and cost studies; and research, development, and consultation in connection with new insurance programs that include development of computerized systems to assist customers in monitoring their accident data. In add ition, it offers claims handling services to clients with self-insurance programs. Further, the company?s reinsurance assumptions business accepts cessions and retrocessions from selected insurance and reinsurance companies, principally reinsuring against catastrophes. Additionally, it provides private passenger automobile liability and physical damage coverage products to individuals through a network of independent agents; commercial property and business owners liability coverage products through a managing general agent; and miscellaneous Professional Liability coverages through wholesale and retail agents. The company was founded in 1930 and is based in Indianapolis, Indiana. Top 10 Performing Stocks To Buy For 2014: Portfolio Recovery Associates Inc.(PRAA) Portfolio Recovery Associates, Inc., a financial and business service company, engages in the purchase, collection, and management of portfolios of defaulted consumer receivables. It detects, collects, and processes unpaid and normal-course accounts receivables owed primarily to credit grantors, governments, and retailers. The company also acquires receivables of Visa, MasterCard, and other credit cards; private label credit cards; installment loans; lines of credit; bankrupt accounts; deficiency balances of various types; legal judgments, and trade payables from various debt owners, including banks, credit unions, consumer finance companies, telecommunication providers, retailers, utilities, insurance companies, medical groups, hospitals, auto finance companies, and other debt buyers. In addition, it provides fee-based services, including vehicle location, skip tracing, and collateral recovery services for auto lenders, governments, and law enforcement; revenue administra tion, audit, and debt discovery/recovery services for local government entities; and class action claims recovery services and related payment processing services. The company was founded in 1996 and is headquartered in Norfolk, Virginia. Top 10 Performing Stocks To Buy For 2014: Range Resources Corporation(RRC) Range Resources Corporation, an independent natural gas company, engages in the acquisition, exploration, and development of natural gas properties primarily in the Appalachian and southwestern regions of the United States. The company?s Appalachian region drilling and producing activities include tight-gas, shale, coal bed methane, and conventional natural gas and oil production in Pennsylvania, Virginia, Ohio, and West Virginia. It owns 4,969 net producing wells, approximately 2,750 miles of gas gathering lines, and approximately 1.8 million gross acres under lease. The company?s Southwestern drilling and producing activities cover the Barnett Shale of North Texas, the Permian Basin of West Texas and eastern New Mexico, the East Texas Basin, the Texas Panhandle, and the Anadarko Basin of Western Oklahoma. It owns 1,954 net producing wells, as well as approximately 886,000 gross acres under lease. As of December 31, 2010, Range Resources Corporation had had 4.4 Tcfe of pr oved reserves. It sells gas to utilities, marketing companies, and industrial users. The company was formerly known as Lomak Petroleum, Inc. and changed its name to Range Resources Corporation in 1998. Range Resources Corporation was founded in 1975 and is headquartered in Fort Worth, Texas. Advisors' Opinion: - [By Louis Navellier]

Range Resources Corp. (NYSE:RRC) is an independent natural gas and oil company that explores, develops and acquires primarily natural gas and oil properties in the U.S. This is another stock that is up big, gaining 46% year to date.

Top 10 Performing Stocks To Buy For 2014: Stornoway Diamond Com Npv (SWY.TO) Stornoway Diamond Corporation engages in the exploration and development of diamond projects in Canada. It principally holds a 100% interest in the Renard diamond project located near the Otish Mountains in north-central Quebec. The company was founded in 1986 and is headquartered in Longueuil, Canada. Top 10 Performing Stocks To Buy For 2014: Investors Bancorp Inc.(ISBC) Investors Bancorp, Inc. operates as the holding company for Investors Savings Bank that provides a range of banking services in the United States. The company accepts deposits and originates loans. Its deposit products include savings accounts, checking accounts, money market accounts, and certificates of deposit. The company offers commercial real estate, construction, multi-family, and commercial and industrial loans; and consumer loans, including home equity loans and home equity lines of credit, as well as mortgage loans secured by one-to four-family residential real estate. As of December 31, 2010, it operated 82 full-service branch offices located in Essex, Hunterdon, Middlesex, Monmouth, Morris, Ocean, Passaic, Somerset, Union, and Warren Counties, New Jersey; Nassau and Queens, New York; and Massachusetts. The company was founded in 1926 and is headquartered in Short Hills, New Jersey. Investors Bancorp, Inc. is a subsidiary of Investors Bancorp, MHC. Top 10 Performing Stocks To Buy For 2014: The Savannah Bancorp Inc.(SAVB) The Savannah Bancorp Inc. operates as a multi-bank holding company that provides commercial and mortgage banking products and services in Georgia and South Carolina. It offers a range of deposit services, including checking accounts, savings accounts, and various time deposits ranging from daily money market accounts to long-term certificates of deposit. The company also offers a range of short-term and medium-term secured, and unsecured commercial loans; consumer loans, including secured loans for financing automobiles, home improvements, real estate, and other personal investments; real estate construction and acquisition loans; and residential mortgage and personal loans. In addition, it provides trust services, including investment management, personal trusts, custodial accounts, estate administration, and retirement plan asset management. The company provides investment services to individuals, families, employee benefit plans, non-profit organizations, and other enti ties. Further, it offers cash management services, remote deposit capture, Internet banking, electronic bill payment, non-cash deposit courier service, safe deposit boxes, travelers checks, direct deposit of payroll, the U.S. savings bonds, official bank checks, money orders, and automatic drafts for various accounts. As of March 31, 2010, the company had 10 banking offices and 12 ATMs in Savannah, Garden City, Skidaway Island, Whitemarsh Island, Pooler, and Richmond Hill, Georgia; and Hilton Head Island and Bluffton, South Carolina. It also had mortgage lending offices in Savannah, Richmond Hill, and Hilton Head Island; an investment management office in Savannah; and a loan production office in St. Simons Island, Georgia. The company was founded in 1989 and is headquartered in Savannah, Georgia. Top 10 Performing Stocks To Buy For 2014: Bank Of Virginia(BOVA) Bank of Virginia provides commercial and retail banking services to small- to medium-sized businesses, professional concerns, and individuals in the greater Richmond metropolitan region, Virginia. It offers a range of deposit services, including interest-bearing and non interest-bearing checking accounts, commercial accounts, savings accounts, individual retirement accounts, daily money market accounts, and longer-term certificates of deposit. The company?s loan portfolio consists of commercial real estate loans, construction and development real estate loans, residential real estate loans, and commercial loans, as well as consumer loans, such as secured and unsecured installment loans, revolving lines of credit, and home equity loans. In addition, it offers other banking services, including safe deposit boxes, cashier?s checks, banking by mail, direct deposit of payroll and social security checks, the U.S. Savings Bonds, and travelers? checks. Further, the company prov ides debit card and credit card services through a correspondent bank as an agent; and lines of credit, telephone banking, and PC/Internet delivery services. As of December 31, 2009, Bank of Virginia had five banking offices located in Chesterfield and Henrico Counties. The company was formerly known as The Community Bank of Virginia. Bank of Virginia was founded in 2002 and is headquartered in Midlothian, Virginia. Bank of Virginia is a subsidiary of Cordia Bancorp Inc.

Washington Post columnist Neil Irwin stopped by to discuss his book, The Alchemists: Three Central Bankers and a World on Fire. It's a great read on the history of central banks, including how they responded to the financial crisis and the challenges they face in the future. In this video segment, Neil reveals his thoughts on who could step into Ben Bernanke's shoes -- assuming he doesn't stay on for a third term -- including two strong possibilities and an intriguing long shot. A full transcript follows the video. Morgan Housel: Bernanke's term is up in January -- January 2014. What are the odds that he's going to stick around, and, if not him, who's going to replace him? Neil Irwin: I don't think he wants to stay. I think he's tired. I think he's ready to go back to a quieter life. Could the president talk him into that? Who knows? I think it's fairly low odds, though, that Ben Bernanke will still be Fed chair this time a year from now. The candidates people talk about, the one who gets talked about the most and probably has the highest odds of any individual of ending up in the job, is Janet Yellen. She's the current vice chair, former Fed governor, former president of the San Francisco Fed. Obama appointed her to the vice chairmanship. She's a very good economist; she has long experience in the Fed system. I think she is the most likely of any individual, but I don't think it's a slam-dunk. I don't think it's a sure thing, by any means, that she'll get the job. If they don't go with her, if the president doesn't go with her, it'll be because he either worries that she's too doveish on inflation and might not be sufficiently attuned to, for example, risks building in the financial system. He may have worries on, does she have the right dynamic ability to handle all these different jobs -- the public-facing aspects of the job, the diplomatic aspects, the political aspects. That said, she is a completely sound candidate, and very well may end up being the next Fed chair. Some other possibilities: Roger Ferguson was the vice chair under Alan Greenspan. He's more experienced on the financial side of things. Janet Yellen is a little more experienced on the economics and monetary policy side. There are some more unconventional names that you hear. One is Jeremy Stein. He's a Fed governor right now. He's given a few thoughtful speeches on the risks of financial bubbles building in asset markets. He's a Harvard economist. He might end up being -- if he were to get the job -- the Ben Bernanke of 2013, in the sense that he kind of came out of nowhere and was an intellectual force. One name that I'm not sure if the president would give any serious consideration to, but I think is an interesting name to mention, a guy named Stan Fischer. He just stepped down as governor of the Bank of Israel. He's been a U.S. citizen since 1976, though he has been a central banker in another country for the last few years. Very respected; he's actually kind of an intellectual godfather to a generation of central bankers. He was Ben Bernanke's thesis advisor at MIT. Also for Mario Draghi, the president of the ECB; he also advised Mario Draghi at MIT. He's, I think, 76, but he's healthy, a brilliant guy, former No. 2 at the IMF. Will he get serious consideration? Would that be too much for Americans to handle, going with somebody with a foreign accent to be the Fed chair? We'll see. I think some of the other candidates are more likely, for all those reasons -- Janet Yellen, Roger Ferguson, and the others I mentioned. More from The Motley Fool

Obamacare will undoubtedly have far-reaching effects. The Motley Fool's new free report "Everything You Need to Know About Obamacare" lets you know how your health insurance, your taxes, and your portfolio could be affected. Click here to read more.

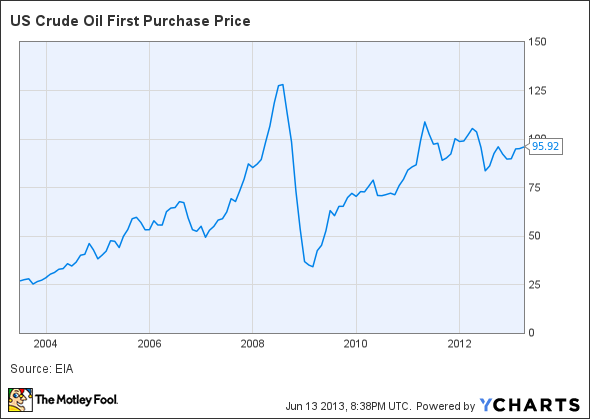

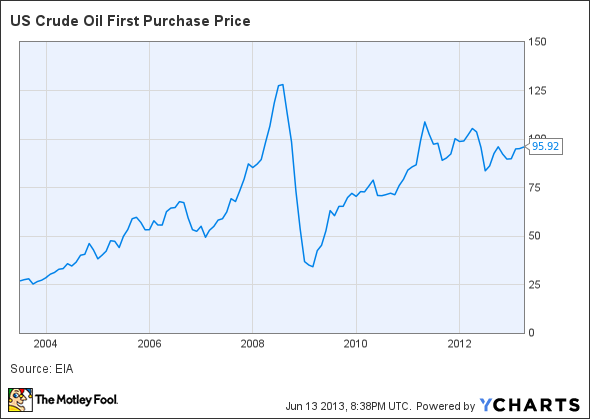

A quick look at a 10-year oil price chart reveals a clear trend: Oil prices are going up. Moreover, oil price increases are not a mere artifact of normal inflation. While the U.S. consumer price index has increased just 26.4% over the past 10 years, oil prices have gained a whopping 257%!

Oil Prices vs. Inflation, data by YCharts The pace of price increases has been anything but steady, but if you exclude oil's rapid spike from mid-2007 to mid-2008 and the subsequent crash period from mid-2008 to mid-2009, you can see a clear uptrend.

US Crude Oil Price Chart, data by YCharts Given this clear uptrend in oil prices, the conventional wisdom today is that oil prices are headed higher, both in real terms and in nominal terms. In fact, when my colleague Travis Hoium recently wrote that U.S. gas prices would never hit $5, dozens of people spoke out to disagree. Many said that they expect gas prices to rise well beyond $5 by the end of the decade. However, this conventional wisdom is probably wrong. First, rising oil prices have significantly reduced long-term demand for oil, as users have implemented efficiency improvements and substituted cheaper fuels (including renewable energy and natural gas) when possible. Second, high oil prices have stimulated the development of new drilling technologies and a new round of crude oil discoveries. In fact, the International Energy Agency stated last month that the recent "positive crude and product 'supply shock' could prove as transformative for the oil industry as was the rise of Chinese demand during the last 15 years." In short, the market has worked just as it should: The change in oil prices changed the behavior of consumers and producers. We now live in a world where there is ample excess oil supply -- the IEA recently estimated OPEC's "effective spare capacity" at more than 3.7 million barrels per day -- and supply will grow at least as quickly as demand for the foreseeable future. As a result, oil prices are likely to stagnate; in fact, expressed in real terms, oil prices are more likely to fall than to rise going forward. A new environment

Not too long ago, many oil market-watchers were concerned about "peak oil": the idea that oil production was nearing a peak, after which declines at existing oil fields would outpace any new production. An article in the January 2012 issue of Nature magazine argued that oil had passed a "tipping point" where increases in demand could no longer be met by supply increases. The authors posited a global production "ceiling" of approximately 75 million barrels per day, beyond which increases in demand would lead to rapid price inflation because of the lack of additional supply. The Nature article appears to be well researched, but it was ultimately untimely. While the authors concluded that oil supply -- and, to a lesser extent, oil demand -- had become inelastic, it now appears that the problem was just one of timing. New extraction techniques such as hydraulic fracturing can be unprofitable when oil prices are below $80 (although that breakeven cost seems to be dropping), but the potential supply of oil grows significantly once prices rise beyond that level. However, the effect is not immediate; it takes time to develop new wells and build the necessary takeaway infrastructure, particularly pipelines. While oil prices spiked well above $80 in 2008, they remained above that level for less than a year. Oil prices have only remained consistently above this $80 "tipping point" since 2011. Similarly, efficiency technologies such as hybrid car engines are more expensive than conventional internal-combustion engines. When oil prices spike, consumers don't all immediately run out to replace their gas-guzzling cars with more fuel-efficient models. However, over time, sustained high oil prices do change car-buying behavior, driving market-share gains for small cars, hybrids, and turbocharged engines. Enter the U.S. supply boom

Now that oil prices have remained above $80 for a while, "tight oil" production has exploded in the United States. In the past four weeks, U.S. crude oil production has averaged 7.27 million barrels per day, according to the U.S. Energy Information Administration. That's up more than 1 million bpd from the comparable four-week period in 2012, and up approximately 1.6 million bpd compared with the production rate in June 2011. Meanwhile, even as the U.S. economy has recovered (albeit very slowly) from the Great Recession, oil consumption has stagnated. People who changed their driving habits in 2008 (e.g., taking public transportation more often) haven't gone back to their old ways. According to the EIA, petroleum "product supplied" is down 1% over the past four weeks compared with the same period in 2012. Efficiency gains

Moreover, U.S. vehicle fuel efficiency has grown by leaps and bounds. In 2012, Toyota Motor (NYSE: TM ) made a big push to boost sales of its Prius model through the introduction of new varieties of the popular hybrid. The time was right, as gas prices remained high in much of the country throughout the year, and sales grew from 136,000 in 2011 to nearly 237,000 in 2012. Even when car buyers have opted not to shell out the extra money for a hybrid, they have been choosing smaller cars. For example, General Motors (NYSE: GM ) saw sales of its subcompact cars (Sonic, Aveo, and Spark) more than double in 2012 compared with 2011. Lastly, on a like-for-like basis, fuel efficiency in cars and trucks is improving, as high gas mileage is now a major selling point. As a result, the fuel efficiency of new vehicles sold in the U.S. improved by about 20% from 2007 to 2012. Will it be enough?

Oil demand is thus stagnant in the U.S. -- and most other OECD countries -- as the effects of modest GDP growth are offset by efficiency improvements. Meanwhile, U.S. oil production is growing rapidly because of the shale revolution. The net result is that U.S. crude oil imports have dropped by 13% year to date, from an average of 8.84 million bpd in 2012 to an average of 7.68 million bpd in 2013. Oil bulls generally argue that modest production increases and stagnant demand in the developed world will be easily offset by surging demand in the developing world, leading to higher prices. China is the most frequently cited example of a large, expanding economy with a rapidly growing need for oil. Indeed, in the past decade or so, China's oil demand has exploded, growing from around 5 million bpd in 2001 to more than 10 million bpd last year. Yet the onset of high oil prices has provided a strong motivation for efficiency in China and other developing countries, not just in slow-growing OECD nations. China's oil consumption is expected to grow by just 4% -- 420,000 bpd -- this year. This growth will "soak up" less than half of the drop in U.S. imports. U.S. oil production in 2018 is expected to be approximately 3.9 million bpd higher than in 2012, meaning that there is plenty of room for declining U.S. oil imports to continue offsetting growth in China and elsewhere. In short, stagnant demand and increasing supply in the OECD countries, particularly the U.S. and Canada, should be sufficient to offset demand growth in the developing world for at least five more years. Beyond that, the "shale revolution" will probably be exported to other countries that still rely on conventional drilling techniques today. While brief supply interruptions may cause price spikes now and again, oil prices will tend to be stagnant (or even trend lower) for the foreseeable future. Foolish bottom line

When oil soared past $100 a barrel in 2008, global oil supplies were very tight. At the peak, in July 2008, the IEA assessed OPEC's effective spare capacity at just 1.5 million bpd. That figure has now risen to more than 3.7 million bpd, indicating a much more benign supply-demand balance. The main reason for this shift is that we needed sustained high oil prices to change consumer behavior -- e.g., driving less often and preferring more fuel-efficient cars -- and to justify new (and more expensive) drilling techniques such as hydraulic fracturing. Now that oil prices have hovered near $100 for some time, supply growth has picked up again while demand is stagnant. Even demand growth in China has paled in comparison with U.S. supply increases. I'll close with one more piece of corroborating evidence. While December 2013 Brent crude futures recently traded for approximately $103 a barrel, December 2019 Brent futures traded for less than $89. Conventional wisdom may say that oil prices will skyrocket sooner or later, but the market is telling us otherwise. Don't underestimate the power of efficiency gains and new drilling techniques to keep oil prices in check for many years to come. Learn more

If you're on the lookout for some currently intriguing energy plays, check out The Motley Fool's "3 Stocks for $100 Oil." For free access to this special report, simply click here now.