LISTEN TO ARTICLE 6:19 SHARE THIS ARTICLE Facebook Twitter LinkedIn Email

Standing high on top of a windswept dune in the West Texas plains, Greg Edwards stares out into a vast ocean of sand. It stretches in every direction, interrupted only by an occasional strip of asphalt or clusters of silos that rise high into the sky.

Edwards runs a frack-sand mine. And those silos mark the presence of his rivals, who suddenly seem to be popping up everywhere. As he turns 360 degrees under the blistering midday sun, he calls out their names one by one: “Badger ... Atlas ... High Roller ... Alpine ... Black Mountain ... Covia.”

#lazy-img-329177313:before{padding-top:66.75%;}

Greg Edwards walks through the sand dunes in Kermit, Texas.Photographer: Callaghan O'Hare/Bloomberg

Twelve months ago, none of them existed -- not even the mine owned by Edwards’s employer, Hi-Crush Partners. It was the first of its kind here in West Texas. Day one was July 31, 2017. Ten others immediately followed. And another 10 or so are now hustling to get started.

Together, they will mine and ship some 22 million tons of sand this year to shale drillers all around them in the Permian Basin, the hottest oil patch on Earth. It is a staggering sum of sand, equal to almost a quarter of total U.S. supply. And within a couple years, industry experts say, the figure could climb to over 50 million tons.

David Cutbirth, the long-time mayor of the nearby town of Monahans, is dumbfounded by it all. Until the miners arrived, these dunes were a quasi-barren wasteland -- good only for weekend adventurers zipping around on buggies. And the price of sand was, well, zero. Today, it fetches $80 a ton, making this year’s haul alone worth about $2 billion.

"I’m in awe everyday," Cutbirth says. "This stuff is worth something?"

There is perhaps no industry that better captures the money-multiplying effect of the Permian boom than the out-of-nowhere emergence of West Texas as a rival to the original capital of U.S. frack-sand mining in northwestern Wisconsin. With such explosive growth, of course, comes the risk of over-expansion. The local miners are unmoved by such talk -- Hi-Crush CFO Laura Fulton actually laughed at the notion -- but to the more dispassionate set of analysts and investors who watch the industry from afar, it is a major risk even if the oil market continues to go strong.

“The fear on Wall Street today is, ‘Oh my gosh, things look great today, but we can’t assume this is gonna last,”’ said Joseph Triepke, a former Jefferies Group analyst who now runs an industry research firm called Infill Thinking. “Look at all this capacity.”

Marble vs. Jelly Bean

This concern is clearly visible in the stock market. Shares of Hi-Crush are down more than 10 percent since mid-May. So too are those of U.S. Silica Holdings and Emerge Energy Services. And Covia Holdings, a new company formed in a merger of two sand powerhouses, has slumped 27 percent since it began trading last month.

All of these miners, with the exception of Emerge, now have operations in West Texas. And they all have quarries back in Wisconsin too. That state had quickly emerged as the epicenter of the sand market when fracking took off a decade ago. Large, rugged and round as marbles, the granules found there are ideally shaped to prop open crevices in shale rock so that the oil can seep out freely.

#lazy-img-329177321:before{padding-top:66.75%;}

Hi-Crush mining facility in Kermit, Texas.Photographer: Callaghan O'Hare/Bloomberg

The West Texas sand isn’t nearly as big or as sturdy. And it’s oddly shaped too -- more like a jelly bean than a marble.

So for years, it was ignored. (No one was even interested in it for use in other industries, like cement or microchips.) But then, in the summer of 2014, the price of oil plunged. Suddenly, cost-cutting was all the rage. And there was no cheaper place to pump shale oil than in the Permian.

As drillers piled into the region, they began to wonder if they really needed to have sand shipped some 1,300 miles by rail from Wisconsin when they had this inferior, but serviceable, stuff lying all around them. Shipping costs from Wisconsin come to about $90 per ton of sand. That’s triple the $25 or so it costs to truck in the Texas sand.

“The business plan is simple,” says Peter Allen, senior project manager at Black Mountain Sand. “We cut out the cost of railing it here.”

Backed by a private-equity firm named Natural Gas Partners, Black Mountain is the biggest outfit in the area. It runs two mines nestled up against a desolate strip of highway that stretches into unincorporated parts of Texas along the border with New Mexico. They’re called Vest and El Dorado. Both are just months old. And both are already cranking out sand at a pace equal to 5 million tons a year.

It takes an army of trucks to haul that much sand to well sites. And they need to get in and out of the mines efficiently. Allen’s target is eight minutes or less. An automated system that knows which sand to feed each truck speeds the process along. Still, they come in so fast that the line can back up quickly. On a recent afternoon, it was several deep. Sergio Pando, a load-out operator, says that’s nothing. On a really hectic day, it can swell to 100.

‘Gold Rush’

Like most everyone else here, Pando was lured to the sand mines by the prospect of big pay. Even unskilled newbies can pull down $19 an hour, almost triple the state’s $7.25-per-hour minimum wage. A student at Texas Tech University, Pando took off the spring semester to start working at Black Mountain. Six months into the job, he’s making $28 an hour.

“You have this flood of people and resources and capital going into this small,

condensed area,” says Allen, who himself was recruited away from Rio Tinto’s U.S. mining operation. “It’s like a gold rush.”

#lazy-img-329177355:before{padding-top:66.75%;}

Sand dunes at a state park near Monahans, Texas.Photographer: Callaghan O'Hare/Bloomberg

This gold rush metaphor comes up again and again in conversations here. Or gold mine. That one is popular too. Fulton, the Hi-Crush CFO, says it’s apt for the situation because, just like the speculators of old, people are trying to snap up land now before the actual mining companies arrive.

“They’re trying to just find something, quickly flip it and make some quick cash,” Fulton says. “They really don’t have the intention of staying and working in the sand industry.”

But as Edwards, the mine manager, stood atop that sand dune later that day and took in the sight of all of those rival silos dotting the horizon, he was struck by something very different. And while he didn’t betray any concern when he said it, there’s a cautionary, almost foreboding, note to the observation: “We knew there were people talking about it. We didn’t know how many would go through with it.”

Mooncoin (CURRENCY:MOON) traded up 5% against the US dollar during the 1 day period ending at 21:00 PM E.T. on July 22nd. In the last week, Mooncoin has traded 26.2% higher against the US dollar. One Mooncoin coin can now be bought for approximately $0.0000 or 0.00000001 BTC on major exchanges. Mooncoin has a market capitalization of $10.08 million and $1,730.00 worth of Mooncoin was traded on exchanges in the last 24 hours.

Mooncoin (CURRENCY:MOON) traded up 5% against the US dollar during the 1 day period ending at 21:00 PM E.T. on July 22nd. In the last week, Mooncoin has traded 26.2% higher against the US dollar. One Mooncoin coin can now be bought for approximately $0.0000 or 0.00000001 BTC on major exchanges. Mooncoin has a market capitalization of $10.08 million and $1,730.00 worth of Mooncoin was traded on exchanges in the last 24 hours.

Greg Edwards walks through the sand dunes in Kermit, Texas.Photographer: Callaghan O'Hare/Bloomberg

Greg Edwards walks through the sand dunes in Kermit, Texas.Photographer: Callaghan O'Hare/Bloomberg Hi-Crush mining facility in Kermit, Texas.Photographer: Callaghan O'Hare/Bloomberg

Hi-Crush mining facility in Kermit, Texas.Photographer: Callaghan O'Hare/Bloomberg Sand dunes at a state park near Monahans, Texas.Photographer: Callaghan O'Hare/Bloomberg

Sand dunes at a state park near Monahans, Texas.Photographer: Callaghan O'Hare/Bloomberg Cabbage (CURRENCY:CAB) traded 5.2% lower against the dollar during the 24-hour period ending at 11:00 AM Eastern on July 7th. One Cabbage coin can now be purchased for approximately $0.0025 or 0.00000038 BTC on exchanges. Cabbage has a total market cap of $26,118.00 and $25.00 worth of Cabbage was traded on exchanges in the last day. Over the last seven days, Cabbage has traded 1.3% higher against the dollar.

Cabbage (CURRENCY:CAB) traded 5.2% lower against the dollar during the 24-hour period ending at 11:00 AM Eastern on July 7th. One Cabbage coin can now be purchased for approximately $0.0025 or 0.00000038 BTC on exchanges. Cabbage has a total market cap of $26,118.00 and $25.00 worth of Cabbage was traded on exchanges in the last day. Over the last seven days, Cabbage has traded 1.3% higher against the dollar.  Wells Fargo & Co set a $55.00 price target on Greenbrier Companies (NYSE:GBX) in a report released on Monday morning. The brokerage currently has a hold rating on the transportation company’s stock.

Wells Fargo & Co set a $55.00 price target on Greenbrier Companies (NYSE:GBX) in a report released on Monday morning. The brokerage currently has a hold rating on the transportation company’s stock.

India's national carrier faces an uncertain future as losses mount.

India's national carrier faces an uncertain future as losses mount.  Equities analysts expect Granite Construction Inc. (NYSE:GVA) to announce earnings per share (EPS) of $0.89 for the current quarter, according to Zacks Investment Research. Two analysts have made estimates for Granite Construction’s earnings, with estimates ranging from $0.88 to $0.90. Granite Construction posted earnings per share of $0.35 in the same quarter last year, which indicates a positive year over year growth rate of 154.3%. The firm is expected to issue its next earnings results on Tuesday, August 7th.

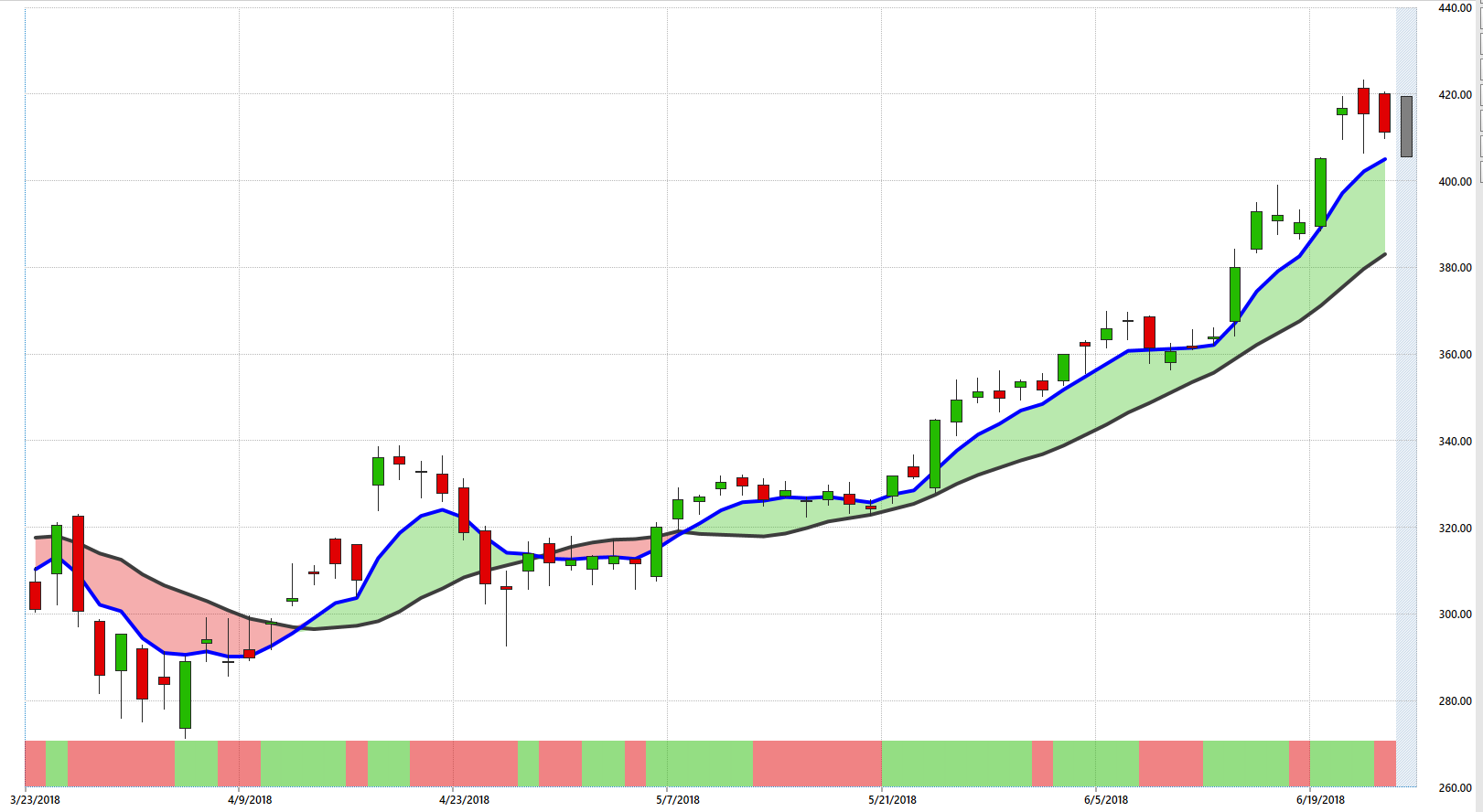

Equities analysts expect Granite Construction Inc. (NYSE:GVA) to announce earnings per share (EPS) of $0.89 for the current quarter, according to Zacks Investment Research. Two analysts have made estimates for Granite Construction’s earnings, with estimates ranging from $0.88 to $0.90. Granite Construction posted earnings per share of $0.35 in the same quarter last year, which indicates a positive year over year growth rate of 154.3%. The firm is expected to issue its next earnings results on Tuesday, August 7th. Affiliated Managers Group, Inc., through its affiliates, operates as an asset management company providing investment management services to mutual funds, institutional clients, and high net worth individuals in the United States. It provides advisory or subadvisory services to mutual funds. These funds are distributed to retail and institutional clients directly and through intermediaries, including independent investment advisors, retirement plan sponsors, broker-dealers, major fund marketplaces, and bank trust departments. The company also offers investment products in various investment styles in the institutional distribution channel, including small, small/mid, mid, and large capitalization value and growth equity, and emerging markets. In addition, it offers quantitative, alternative, and fixed income products, and manages assets for foundations and endowments, defined benefit, and defined contribution plans for corporations and municipalities. Affiliated Managers Group provides investment management or customized investment counseling and fiduciary services. The company was formed as a corporation under the laws of Delaware in 1993. Affiliated Managers Group is based in Prides Crossing, Massachusetts.

Affiliated Managers Group, Inc., through its affiliates, operates as an asset management company providing investment management services to mutual funds, institutional clients, and high net worth individuals in the United States. It provides advisory or subadvisory services to mutual funds. These funds are distributed to retail and institutional clients directly and through intermediaries, including independent investment advisors, retirement plan sponsors, broker-dealers, major fund marketplaces, and bank trust departments. The company also offers investment products in various investment styles in the institutional distribution channel, including small, small/mid, mid, and large capitalization value and growth equity, and emerging markets. In addition, it offers quantitative, alternative, and fixed income products, and manages assets for foundations and endowments, defined benefit, and defined contribution plans for corporations and municipalities. Affiliated Managers Group provides investment management or customized investment counseling and fiduciary services. The company was formed as a corporation under the laws of Delaware in 1993. Affiliated Managers Group is based in Prides Crossing, Massachusetts. Wall Street analysts forecast that Ctrip.Com International Ltd (NASDAQ:CTRP) will report earnings per share (EPS) of $0.22 for the current fiscal quarter, according to Zacks. Three analysts have made estimates for Ctrip.Com International’s earnings, with estimates ranging from $0.20 to $0.26. Ctrip.Com International posted earnings per share of $0.09 in the same quarter last year, which indicates a positive year-over-year growth rate of 144.4%. The business is expected to report its next earnings results on Wednesday, August 29th.

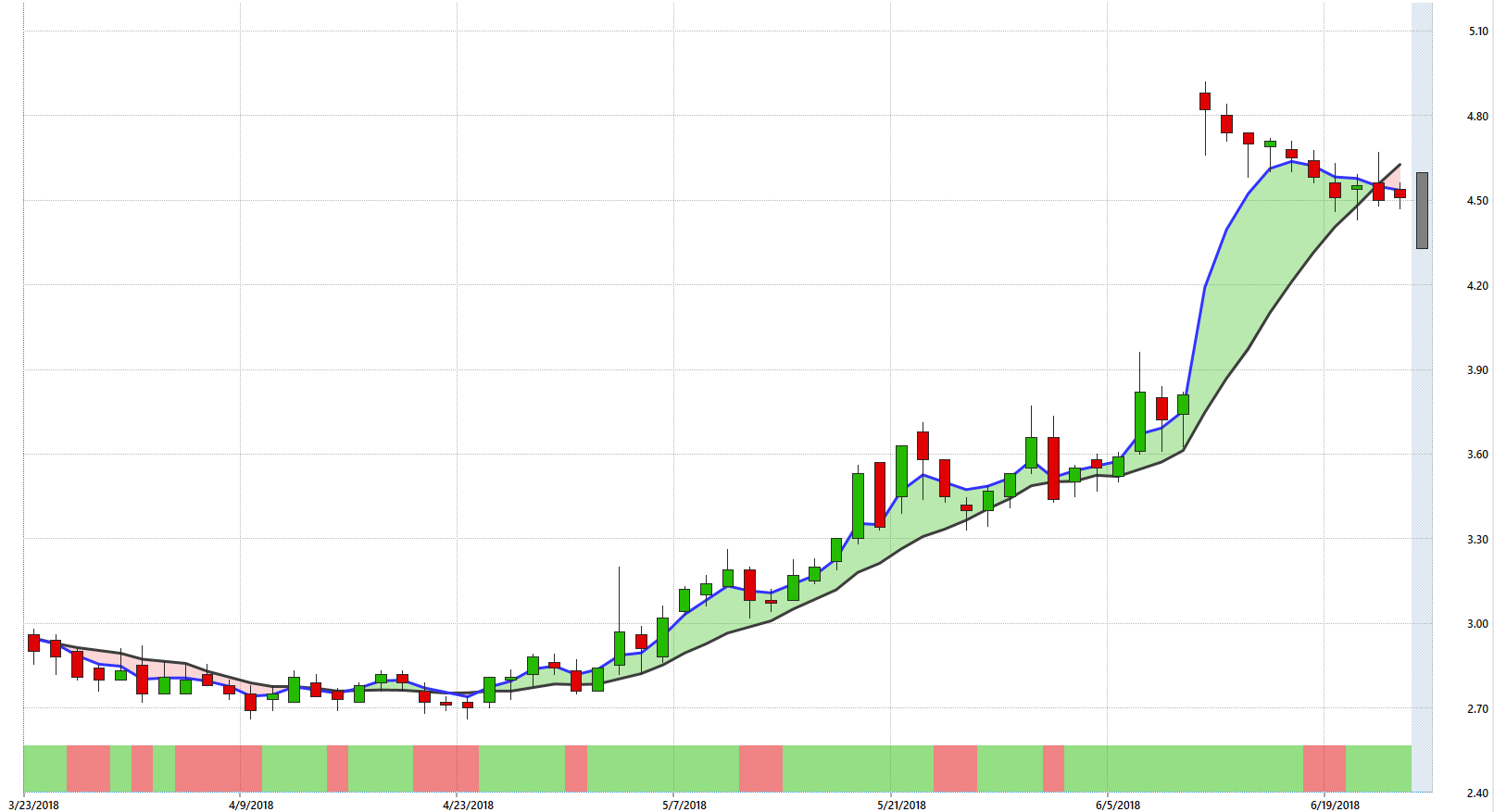

Wall Street analysts forecast that Ctrip.Com International Ltd (NASDAQ:CTRP) will report earnings per share (EPS) of $0.22 for the current fiscal quarter, according to Zacks. Three analysts have made estimates for Ctrip.Com International’s earnings, with estimates ranging from $0.20 to $0.26. Ctrip.Com International posted earnings per share of $0.09 in the same quarter last year, which indicates a positive year-over-year growth rate of 144.4%. The business is expected to report its next earnings results on Wednesday, August 29th. 24/7 Wall St.

24/7 Wall St.