10 Best Energy Stocks To Watch For 2014

Alamy Tax season is a time of stress for many, but it can be a joyful time for the roughly 75 percent of Americans who receive income tax refunds. While the refund really means you're getting back money you loaned to the government at no interest, in practical terms it often means an unexpected infusion of cash into your wallet or bank account. Last year's average income tax refund was $2,755, according to the Internal Revenue Service. That's a nice chunk of change. It's a great problem to have: What do you do with your windfall? The best choice for one person may not be the best choice for another. But experts agree on one thing: If you have debt, apply your refund to paying it off, whether it's credit card debt, student loan debt or other consumer debt. "People should still be focusing first on paying down debt," says Meisa Bonelli, a Wall Street finance and tax professional whose Millennial Tax company advises entrepreneurs on business and tax strategy. Debt, particularly student loan debt, should be a primary target because it limits financial options, preventing people from doing what they want with their money, whether it's buying a house, buying a car or taking a vacation. "Get that debt gone," she says. "It holds you back from everything else you want to do in life." Eric Rosenberg, a financial analyst who writes the blog Narrow Bridge Finance, agrees. "The No. 1 thing anyone should do with a tax refund is pay down debt," he says. After he left graduate school with $40,000 in student loan debt, he focused on aggressively paying it off. Using all his tax refunds and bonuses, he made the final payment just two years and six days after his graduation. With his student loan debt cleared away, he began saving his tax refunds, with the goal of buying a home. He didn't apply any of his refund money to splurges -- instead, he saved for fun and vacation with his regular income. The refunds were earmarked for bigger things. "I treated it like it was extra money that I didn't need to live on," Rosenberg says. "I always encourage people to think long term, not short term." Others believe that giving yourself license to splurge with part of your refund helps you save the rest. Stephanie Halligan, a financial consultant and blogger, signs a contract with herself before she does her taxes, allocating 50 percent of her refund to student loans and 25 percent to long-term savings. She can spend the remaining 25 percent on whatever she wants. "It's easy to react on impulse and emotion when your refund hits, so prepare now for what you'll do with that moolah later," she advises on her personal finance website, The Empowered Dollar. If you're getting a big refund -- a check in the ballpark of $1,000 or more for taxpayers who don't have a side business -- consider adjusting your withholding so that you'll have that money available to you during the year. But those who don't have substantial savings want to avoid a scenario in which they owe four figures to the IRS at tax time. "I think people should withhold the maximum they can withhold," Bonelli says. Rosenberg concurs. As his businesses, running Narrow Bridge Finance and building websites, have grown, his refunds have shrunk. Last year he had to pay the IRS. Here are the seven smartest things you can do with your refund: Pay down debt. If you have any consumer debt -- student loans, credit card balances or installment loans -- pay those off before using your refund for any other purpose. Car payments and home mortgages aren't in this category, but you can consider paying extra principal. Add to your savings. "You can never save enough," Bonelli says. You can use the money to build up your emergency fund, your kids' college funds or put it toward a specific goal, such as buying a house or a car or financing a big vacation. Add to your retirement accounts. If you put $2,500 from this year's tax refund into an IRA, it would grow to $8,500 in 25 years, even at a modest 5 percent rate of return, TurboTax calculates. If you saved $2,500 every year for 25 years, you'd end up with more than $130,000 at that same 5 percent rate of return. Invest in yourself. This could mean taking a class in investing, studying something that interests you or even taking a big trip. "Do something that enriches yourself or adds value to your life," Bonelli says. She is planning to take a class in art therapy this year using money from her refund. Improve your home. Consider putting your refund to good use by adding insulation, replacing old windows and doors or other improvements that would save energy, and therefore money. Or perhaps it's time to remodel your bathroom or kitchen. You're adding value to your home at the same time you're improving your living experience. Apply your refund toward next year's taxes. This is common among self-employed taxpayers, who are required to pay quarterly taxes since they don't have taxes withheld. By applying any overpayment toward upcoming tax payments, you can free up other cash.

Alamy Tax season is a time of stress for many, but it can be a joyful time for the roughly 75 percent of Americans who receive income tax refunds. While the refund really means you're getting back money you loaned to the government at no interest, in practical terms it often means an unexpected infusion of cash into your wallet or bank account. Last year's average income tax refund was $2,755, according to the Internal Revenue Service. That's a nice chunk of change. It's a great problem to have: What do you do with your windfall? The best choice for one person may not be the best choice for another. But experts agree on one thing: If you have debt, apply your refund to paying it off, whether it's credit card debt, student loan debt or other consumer debt. "People should still be focusing first on paying down debt," says Meisa Bonelli, a Wall Street finance and tax professional whose Millennial Tax company advises entrepreneurs on business and tax strategy. Debt, particularly student loan debt, should be a primary target because it limits financial options, preventing people from doing what they want with their money, whether it's buying a house, buying a car or taking a vacation. "Get that debt gone," she says. "It holds you back from everything else you want to do in life." Eric Rosenberg, a financial analyst who writes the blog Narrow Bridge Finance, agrees. "The No. 1 thing anyone should do with a tax refund is pay down debt," he says. After he left graduate school with $40,000 in student loan debt, he focused on aggressively paying it off. Using all his tax refunds and bonuses, he made the final payment just two years and six days after his graduation. With his student loan debt cleared away, he began saving his tax refunds, with the goal of buying a home. He didn't apply any of his refund money to splurges -- instead, he saved for fun and vacation with his regular income. The refunds were earmarked for bigger things. "I treated it like it was extra money that I didn't need to live on," Rosenberg says. "I always encourage people to think long term, not short term." Others believe that giving yourself license to splurge with part of your refund helps you save the rest. Stephanie Halligan, a financial consultant and blogger, signs a contract with herself before she does her taxes, allocating 50 percent of her refund to student loans and 25 percent to long-term savings. She can spend the remaining 25 percent on whatever she wants. "It's easy to react on impulse and emotion when your refund hits, so prepare now for what you'll do with that moolah later," she advises on her personal finance website, The Empowered Dollar. If you're getting a big refund -- a check in the ballpark of $1,000 or more for taxpayers who don't have a side business -- consider adjusting your withholding so that you'll have that money available to you during the year. But those who don't have substantial savings want to avoid a scenario in which they owe four figures to the IRS at tax time. "I think people should withhold the maximum they can withhold," Bonelli says. Rosenberg concurs. As his businesses, running Narrow Bridge Finance and building websites, have grown, his refunds have shrunk. Last year he had to pay the IRS. Here are the seven smartest things you can do with your refund: Pay down debt. If you have any consumer debt -- student loans, credit card balances or installment loans -- pay those off before using your refund for any other purpose. Car payments and home mortgages aren't in this category, but you can consider paying extra principal. Add to your savings. "You can never save enough," Bonelli says. You can use the money to build up your emergency fund, your kids' college funds or put it toward a specific goal, such as buying a house or a car or financing a big vacation. Add to your retirement accounts. If you put $2,500 from this year's tax refund into an IRA, it would grow to $8,500 in 25 years, even at a modest 5 percent rate of return, TurboTax calculates. If you saved $2,500 every year for 25 years, you'd end up with more than $130,000 at that same 5 percent rate of return. Invest in yourself. This could mean taking a class in investing, studying something that interests you or even taking a big trip. "Do something that enriches yourself or adds value to your life," Bonelli says. She is planning to take a class in art therapy this year using money from her refund. Improve your home. Consider putting your refund to good use by adding insulation, replacing old windows and doors or other improvements that would save energy, and therefore money. Or perhaps it's time to remodel your bathroom or kitchen. You're adding value to your home at the same time you're improving your living experience. Apply your refund toward next year's taxes. This is common among self-employed taxpayers, who are required to pay quarterly taxes since they don't have taxes withheld. By applying any overpayment toward upcoming tax payments, you can free up other cash.

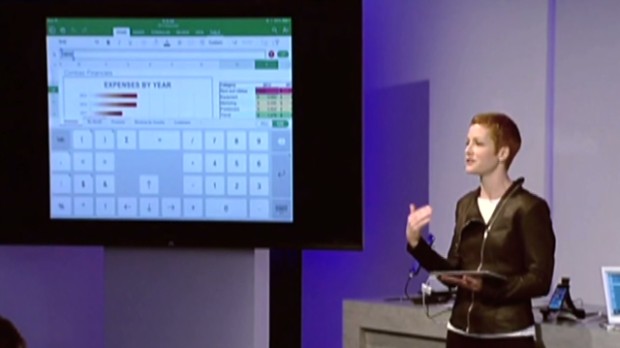

See Microsoft's new Office for iPad NEW YORK (CNNMoney) After years of speculation, Microsoft Office is finally on the iPad.

See Microsoft's new Office for iPad NEW YORK (CNNMoney) After years of speculation, Microsoft Office is finally on the iPad.

Related BZSUM Market Wrap For March 5: Markets Calm Following Tuesday's Massive Rally Mid-Day Market Update: Smith & Wesson Surges On Upbeat Results; XOMA Shares Drop

Related BZSUM Market Wrap For March 5: Markets Calm Following Tuesday's Massive Rally Mid-Day Market Update: Smith & Wesson Surges On Upbeat Results; XOMA Shares Drop